- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Tuesday 24 November 2020

Overnight on Wall Street: Tuesday 24 November 2020

November 23, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

It was a mixed performance in the global stock market on Monday. While vaccine news continues to reassure investors and provide a perception of a return to normal in the near future, the threat to the economy following the various forms of restrictions to contain the surge in infections are weighing on investors’ minds.

AstraZeneca announced that “positive high-level results from an interim analysis of clinical trials of AZD1222 in the UK and Brazil showed the vaccine was highly effective in preventing COVID-19, the primary endpoint, and no hospitalisations or severe cases of the disease were reported in participants receiving the vaccine. There were a total of 131 COVID-19 cases in the interim analysis.”

In the US share market, major US equities eked out modest gains on vaccine updates despite the status quo – no fiscal stimulus, rising COVID-19 cases and deaths, and more restrictions:

- The Dow Jones Industrial Average added 328 points or 1.1% to 29,591.

- S&P 500 rose by 20 points or 0.6% to 3,578.

- Nasdaq Composite added 26 points or 0.2% to 11,881.

Currency Markets

In the FX space, major currencies were mixed against the US dollar. The greenback made a strong recovery on the back of upbeat US manufacturing and services data. The British Pound was among the best performing currencies buoyed by positive related Brexit headlines while safe-haven currencies like the Japanese Yen and Swiss franc edged lower on more promising vaccine news.

On the economic front, PMI figures in Australia, the US and UK was mostly upbeat compared to the mixed performance in the Eurozone:

Australia

- Flash Australia Composite Output Index Nov: 54.7, 4-month high

- Flash Australia Services Business Activity Index Nov: 54.9, 4-month high

- Flash Australia Manufacturing Output Index Nov: 53.3, 2-month high

- Flash Australia Manufacturing PMI Nov: 56.1, 35-month high

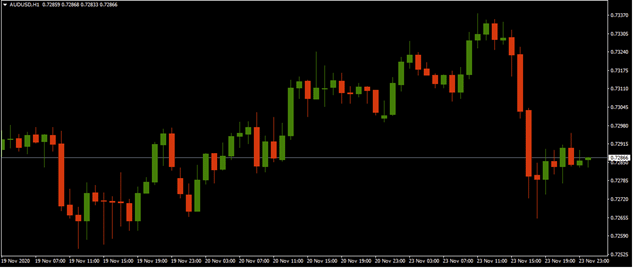

The AUDUSD pared gains made in the Asian session and dropped from a high of 0.7338 to a low of 0.7265.

Source: GO MT4

United Kingdom

- Flash UK Composite Output Index Nov: 47.4, 6-month low

- Flash UK Services Business Activity Index Nov: 45.8, 6-month low

- Flash UK Manufacturing Output Index Nov: 56.3, 2-month high

- Flash UK Manufacturing PMI Nov: 55.2, 3-month high

United States

- Flash U.S. Composite Output Index at 57.9, 68-month high.

- Flash U.S. Services Business Activity Index at 57.7, 68-month high.

- Flash U.S. Manufacturing PMI at 56.7, 4-month high.

- FlashU.S. Manufacturing Output Index at 58.7, 68-month high.

Germany

- Flash Germany PMI Composite Output Index at 52.0, 5-month low.

- Flash Germany Services PMI Activity Index at 46.2, 6-month low.

- Flash Germany Manufacturing Output Index at 62.7, 2-month low.

- Flash Germany Manufacturing PMI at 57.9, 2-month low.

Eurozone

- Flash Eurozone PMI Composite Output Index(at 45.1, 6-month low.

- Flash Eurozone Services PMI Activity Index at 41.3, 6-month low.

- Flash Eurozone Manufacturing PMI Output Index at 55.5, 4-month low.

- Flash Eurozone Manufacturing PMI at 53.6, 3-month low.

The Canadian dollar was also among the best G10 currencies buoyed by firmer commodity prices. For the chart of the day, Adam Taylor takes a look at the NZDCAD pair:

Fundamental positives for both the New Zealand Dollar and the Canadian Dollar continue to stack up this week as the commodities space shows renewed interest, and discussions of successful Covid-19 vaccines seem to increase daily. However, it’s the New Zealand Dollar that’s stealing the headlines at this moment in time, printing 2020 highs against the US Dollar, and in the battle of the ‘Commdolls,’ this one appears to have the advantage.

The technical picture suggests we could be in for further NZDCAD rallies based on the current bullish trend’s strength. With the price action well above the Ichimoku cloud on the four hourly charts, the NZD looks adequately supported. The lagging span (purple line) similarly situated above the cloud is further confirmation of this idea.

Despite the bullish tendencies, there does appear a slight divergence occurring on the RSI indicator, so the prospect of a correction may not be too far off. If we follow the Ichimoku cloud levels, the psychological price of 90.00 presents itself as a possible target for such an event before rebounding to upper zones. The previous low of 84.50 would be another price point to monitor as moves past this price could tip the scales to a more bearish outlook in the shorter-term.

To the upside, the last time we saw price action around these levels was back in Mar/Apr 2019, during which period we saw a high of 92.18. price-wise, we’re still a fair distance from this point, but certainly, one to consider as the latest trend develops.

Commodities

Crude oil prices continue to climb higher on another positive vaccine news fuelled by the hopes of a recovery on the oil demand outlook. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $43.06 and $45.76 respectively. Traders will likely keep monitoring weekly oil reports and OPEC commitments to production cuts for fresh trading impetus.

Gold

Gold

The precious metal plunged the most in four months, underpinned by vaccine news and a stronger US dollar. As of writing, the XAUUSD pair was trading around $1,837.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Imports, Exports, Trade Balance and RBA’s Debelle speech (Australia)

- Gross Domestic Product and IFO – Business Climate, Current Assessment and Expectations (Germany)

- BoE’s Haskel Speech (UK)

- BoJ’s Governor Kuroda Speech (Japan)

- Housing Price Index, S&P/Case-Shiller Home Price Indices, Consumer Confidence and Fed’s Williams Speech US)

- RBNZ Financial Stability Report (New Zealand)

| Wednesday, 25 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.058 | 0 | 0.13 | 0.072 | 0.481 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Wednesday 25 November 2020

Previous: COTD: NZDCAD- Strong Bullish Trend Prevails